Loading

Get De Form Lq2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the De Form Lq2 online

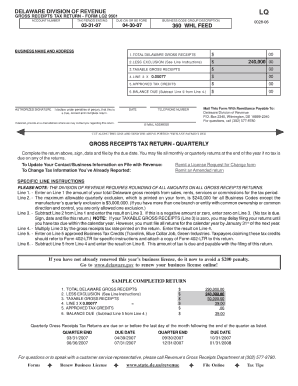

The De Form Lq2 is an important document that requires careful completion. This guide provides a step-by-step approach to help you successfully fill out the form online, ensuring all necessary information is accurately captured.

Follow the steps to complete your De Form Lq2 online

- Click the ‘Get Form’ button to obtain the De Form Lq2 and open it in a suitable editor.

- Begin by reviewing the instructions provided at the top of the form to understand the purpose and requirements.

- Fill in your personal information in the designated fields, including your full name, address, and contact details.

- Enter any relevant identification numbers or codes as specified in the form, ensuring accuracy to avoid delays.

- Review the section that requires details about your situation or the context in which the form is being filled out, providing concise and factual information.

- Check for any additional documentation you may need to upload or reference as part of your submission.

- Once all fields are completed, carefully review your entries for accuracy and completeness.

- Save your changes to ensure all data is preserved before finalizing the form.

- After saving, choose the option to download, print, or share the completed De Form Lq2 as necessary.

Complete your De Form Lq2 online today for efficient document management.

Gross receipts tax is a straightforward tax based on a business’s total revenue, with rates varying by type of business. Unlike other tax systems, it applies to all sales regardless of expenses. Filing this tax correctly is essential, and the De Form Lq2 helps simplify the reporting process. Being well-informed about how this tax works can greatly benefit your business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.