Loading

Get Connecticut Form Au 330

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Connecticut Form Au 330 online

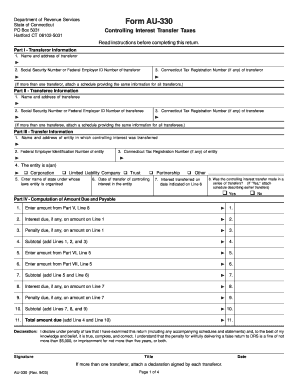

The Connecticut Form Au 330 is essential for reporting controlling interest transfer taxes. This guide provides clear, step-by-step instructions to help users effectively fill out this form online, ensuring compliance with state regulations.

Follow the steps to complete the Connecticut Form Au 330 online.

- Click ‘Get Form’ button to access the Connecticut Form Au 330 and open it in your document editor.

- In Part I, enter the name and address of the transferor, along with their Social Security Number or Federal Employer ID Number. If there is more than one transferor, provide the same information for each on a separate schedule.

- Proceed to Part II. Here, fill in the name and address of the transferee, along with their Social Security Number or Federal Employer ID Number. Again, for multiple transferees, include their information on additional schedules.

- In Part III, provide the details of the entity in which the controlling interest was transferred, including its name, address, and Federal Employer Identification Number. Select the appropriate type of entity and indicate the date of transfer.

- In Part IV, compute the amount due. Enter the relevant amounts for interest and penalties, and calculate the subtotal. This section is vital for determining the total amount owed.

- Complete Part V by detailing any interests in Connecticut real property owned directly by the entity. Provide values, tax rates, and locations. Ensure to calculate the total tax for direct ownership.

- In Part VI, list Connecticut farm land and forest land details similarly as in Part V, ensuring that you calculate and report the total tax.

- Part VII requires information on open space land owned directly by the entity. Input necessary details and summarize the total tax.

- Finally, in Part VIII, list direct owners of any Connecticut real property that is indirectly owned. Make sure to include all relevant names and addresses.

- After filling out all sections, review the form for accuracy. Users can then save changes, download, print, or share the completed form as needed.

Start filling out your Connecticut Form Au 330 online to ensure compliance and accurate reporting.

You can find Connecticut state tax forms, including Connecticut Form Au 330, on the official Connecticut Department of Revenue Services website. Many forms are available for download, making it easy for you to access what you need. Additionally, uslegalforms provides a convenient platform to find and manage state tax forms, ensuring that you have everything organized for your tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.