Loading

Get 1096 Misc Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1096 Misc Fillable Form online

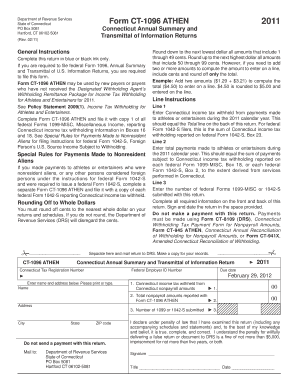

Filling out the 1096 Misc Fillable Form online is a straightforward process that allows you to report Connecticut income tax withholding for payments made to athletes and entertainers. This guide will provide you with clear, step-by-step instructions to assist you in completing the form accurately.

Follow the steps to fill out the 1096 Misc Fillable Form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Provide your Connecticut Tax Registration Number and Federal Employer ID Number at the top of the form.

- Enter the name and address of the person or entity filing the form. Be sure to print or type the information clearly.

- On Line 1, input the total amount of Connecticut income tax withheld from payments made to athletes or entertainers during the calendar year, ensuring this matches the Total line on the back of the return.

- For Line 2, enter the total payments made to athletes or entertainers during the calendar year, ensuring the figures correspond to the sums reported on federal Forms 1099-MISC or 1042-S.

- Indicate the total number of federal Forms 1099-MISC or 1042-S that are included with this return on Line 3.

- After completing all required fields on both the front and back of the form, sign and date it in the designated area.

- Do not include a payment with this return. If payment is necessary, use the appropriate Connecticut withholding tax payment form.

- Save your changes, and then you can download, print, or share the completed form as needed.

Complete your filing process for the 1096 Misc Fillable Form online today.

The IRS Form 1096 is a summary and transmittal form for information returns submitted to the IRS. It acts as a cover sheet for types of forms like 1099s and provides key details about your submissions. Understanding the 1096 Misc Fillable Form is important for accurate reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.