Get Alabama Business Personal Property Return Faq Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

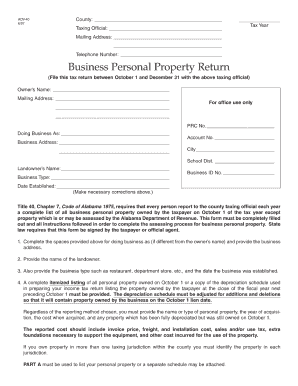

How to fill out the Alabama Business Personal Property Return Faq Form online

Filling out the Alabama Business Personal Property Return Faq Form online can be a straightforward process when guided correctly. This guide offers step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the document and open it in your selected editor.

- Begin with the business identification section. Enter the name of your business and provide the relevant identification number as required.

- Complete the property details section. List all personal property owned by the business, ensuring to categorize each item appropriately and provide descriptions as requested.

- Review the valuation portion of the form. Calculate and enter the assessed value for each item, based on the guidelines provided within the form.

- Fill in any additional information required, such as the business's physical location and contact details. Confirm that all information is accurate and up to date.

- Final review: Go through all entered information to ensure that it is correct. Make any necessary edits before finalizing the form.

- Once satisfied with your entries, you have the option to save changes, download, print, or share the completed form as necessary.

Complete your Alabama Business Personal Property Return Faq Form online today to ensure timely and accurate submissions.

Related links form

To mail your Alabama tax return, first, ensure you have completed the Alabama Business Personal Property Return Faq Form accurately. Then, place it in an envelope and address it to the appropriate tax office based on your location. You can find the correct address on the Alabama Department of Revenue's website. Finally, consider using certified mail for tracking and confirmation of receipt.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.