Loading

Get Instructions For Mt 151 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Mt 151 Form online

Filling out the Instructions For Mt 151 Form online can be a straightforward process if you follow the right steps. This guide provides comprehensive instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Instructions For Mt 151 Form online.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

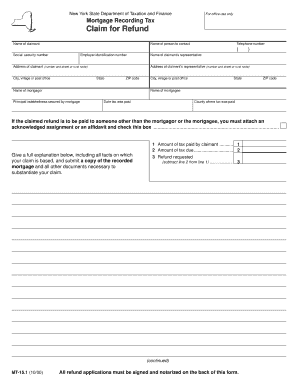

- Fill in the ‘Name of claimant’ field with your full name as it appears in official records.

- Provide the ‘Name of person to contact’ and their corresponding ‘Telephone number’ for any inquiries related to your claim.

- Enter the ‘Social security number’ and ‘Employer identification number’ if applicable. Ensure these numbers are accurate to avoid processing delays.

- Complete the ‘Address of claimant’ and ‘Address of claimant’s representative’ sections, including city, state, and ZIP code.

- Input the ‘Name of mortgagor’ and ‘Name of mortgagee’ in the designated fields.

- Fill in the ‘Principal indebtedness secured by mortgage’ and the ‘Date tax was paid’ accurately.

- Identify the ‘County where tax was paid’ to ensure the claim is directed to the correct jurisdiction.

- If the refund is to be paid to someone other than the mortgagor or mortgagee, attach the required acknowledged assignment or affidavit.

- Calculate the ‘Refund requested’ by subtracting line 2 (amount of tax due) from line 1 (amount of tax paid).

- Provide a full explanation below the calculation, including all relevant facts supporting your claim, and attach any necessary documents.

- Ensure that all applications are signed and notarized as required before submission.

- Once all fields are completed, save your changes, and choose to download, print, or share the form as needed.

Start filling out your documents online today for a smooth and efficient process.

The Power of Attorney (POA) form for Michigan sales tax allows you to authorize someone else to act on your behalf. This can simplify the submission of your sales tax returns and other filings. For clear steps on filing, refer to the Instructions For Mt 151 Form for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.