Get Form Lpf 01

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Lpf 01 online

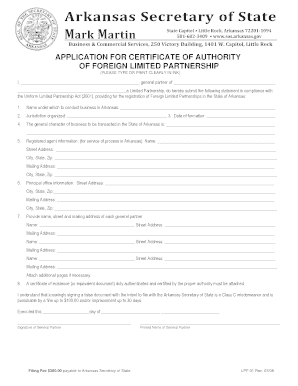

Filling out the Form Lpf 01 online is a crucial step for foreign limited partnerships seeking to conduct business in Arkansas. This guide provides a detailed walkthrough of the form's components, ensuring that users can easily navigate and complete it accurately.

Follow the steps to successfully complete the Form Lpf 01 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with entering the name under which your partnership will conduct business in Arkansas in the designated field.

- Provide the jurisdiction where your limited partnership was organized, making sure to type this information clearly.

- Input the date of formation of your limited partnership in the specified field.

- Detail the general character of business to be transacted in Arkansas, ensuring you describe your business activities comprehensively.

- Fill out the registered agent information for service of process in Arkansas. Include their name, street address, city, state, zip code, and mailing address.

- Provide the principal office information, including the street address, city, state, zip code, and mailing address.

- List the names, street addresses, and mailing addresses of each general partner, attaching additional pages if required to accommodate all partners.

- Ensure that you attach a certificate of existence or equivalent document, duly authenticated and certified by the relevant authority.

- Review all entered information for accuracy. After ensuring the form is complete, save your changes, and choose your preferred option to download, print, or share the form.

Complete your document filings online today to ensure compliance and streamline your business processes.

The key difference between a Limited Partnership Fund (LPF) and an Open-Ended Fund Company (OFC) lies in their management and regulatory frameworks. An LPF typically has a closed structure allowing limited partners to invest, while an OFC operates on an open basis where shares are bought and sold. Understanding these differences is crucial for choosing the right investment structure for your needs. For assistance in navigating these options, consider using USLegalForms, which provides clear information and support.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.