Get Ct Premium Tax Extension Forms 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Premium Tax Extension Forms online

This guide offers clear, step-by-step instructions for filling out the Ct Premium Tax Extension Forms online, ensuring a smooth and efficient process for users with varying levels of experience. Understanding each section of the form will help you complete it accurately and on time.

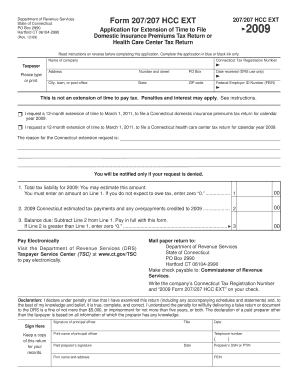

Follow the steps to complete your application for extension

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the company's name, address, and Federal Employer Identification Number (FEIN) in the designated fields. Ensure this information is complete and accurate to avoid processing issues.

- Provide your Connecticut Tax Registration Number in the appropriate section. This number is essential for linking your application to your tax records.

- Indicate the type of extension request by checking the applicable box for either the Connecticut domestic insurance premiums tax return or the health care center tax return.

- In the fields provided, state the total tax liability for the calendar year. You must enter an amount on Line 1. If you do not anticipate owing any taxes, enter zero '0.'

- List any Connecticut estimated tax payments and overpayments credited to the year on Line 2. Accurate reporting here is crucial for calculating your balance due.

- Calculate the balance due on Line 3 by subtracting Line 2 from Line 1. If Line 2 exceeds Line 1, enter zero '0.' This amount needs to be paid in full along with your form.

- Complete the declaration section by signing and dating the form as required. The principal officer of the company must endorse the document.

- If applicable, enter the information for any paid preparers, including their signature, Social Security Number (SSN) or Preparer Tax Identification Number (PTIN), and firm's Federal Employer Identification Number (FEIN).

- Review all entries for accuracy. Save any changes you made during the process before proceeding to download, print, or share the completed form.

Complete and submit your Ct Premium Tax Extension Forms online today to ensure your tax obligations are met efficiently.

The extension form for CT taxes is Form CT-1040 EXT, which allows taxpayers to apply for an automatic extension to file their income taxes. This form is straightforward and must be submitted by the original tax deadline. Remember, while it extends your filing time, it does not extend your payment due date. To ensure timely submissions, consider using Ct Premium Tax Extension Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.