Loading

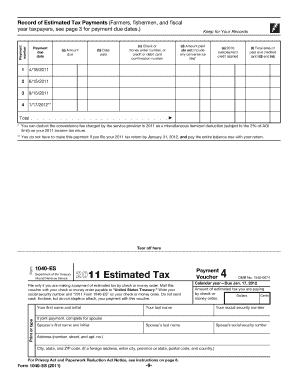

Get Irs Form 10es 2011 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 10es 2011 online

This guide provides you with comprehensive instructions on filling out the Irs Form 10es 2011 online. By following these steps, you can ensure that your form is completed accurately and efficiently.

Follow the steps to successfully complete the Irs Form 10es 2011.

- Click ‘Get Form’ button to access the form and open it in your editing environment.

- Review the form's introductory section where you will find important information about eligibility and requirements. Ensure that you meet the necessary criteria to file the form.

- Fill in your personal information in the designated fields. This usually includes your name, address, and social security number. Ensure that all details are accurate to avoid processing delays.

- Navigate to the income section. Here, you will enter details regarding your earnings. Be thorough and precise to guarantee that your reported income reflects your financial situation.

- Complete the necessary deductions section. You may need to provide additional documentation or calculations. Check each item carefully to maximize your eligible deductions.

- Review any tax credits applicable to your situation. Fill in the required fields with the necessary details to claim any credits you qualify for.

- Double-check all entries for accuracy and completeness. If possible, consider having a trusted person review the form before submission.

- Once you are satisfied with the completed form, save your changes, and choose to download, print, or share the document as needed.

Complete your Irs Form 10es 2011 online today to ensure timely processing.

To file a FATCA form, you need to gather all necessary documentation that details your foreign assets. The process involves completing IRS Form 8938, which reports specified foreign financial assets if they exceed certain thresholds. After filling out the form, you submit it with your annual tax return. If you require assistance, uslegalforms can guide you through using IRS Form 10es 2011 and filing FATCA forms accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.