Loading

Get Form 656b 2013-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 656b online

Filling out Form 656b online is an important step toward reaching a compromise with the IRS regarding your tax debt. This guide provides comprehensive instructions to help you complete the form accurately and effectively.

Follow the steps to successfully complete Form 656b online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by gathering your financial information. This includes your assets, income, expenses, and any necessary documentation to support your offer.

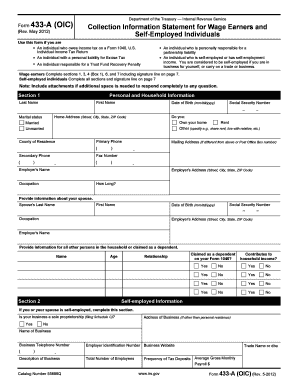

- Complete Form 433-A (OIC) if you are a wage earner or self-employed. This form will require financial details about your income and expenses.

- If your business is classified as a corporation or partnership, fill out Form 433-B (OIC). This will detail your business assets and income.

- Once you have completed the necessary financial forms, proceed to fill out Form 656. This form specifies the tax years and the offer amount you are requesting.

- Include your initial payment and the $150 application fee. Make sure your payments are in U.S. dollars and payable to the 'United States Treasury.'

- Review your application package to ensure all forms are completed and signed, and all required documentation is attached.

- Mail the application package to the appropriate IRS facility based on your state. Consider using Certified Mail for proof of mailing.

Start filling out your Form 656b online today to take a significant step toward settling your tax debt.

Finding the best tax debt relief company involves considering expertise and support. Companies that focus on Form 656b tend to have a deep understanding of tax regulations. Look for a provider with positive client feedback and comprehensive services. By doing your research, you can select a company that aligns with your needs and goals, helping you achieve financial relief.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.