Loading

Get 2011 Form W 4p 2013-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form W 4p online

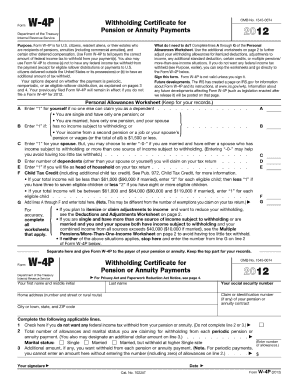

Filling out the 2011 Form W 4p is an essential task for ensuring accurate tax withholding for pension or annuity payments. This guide provides a clear step-by-step approach to assist users in completing this form online with ease.

Follow the steps to complete your form accurately and efficiently.

- Click 'Get Form' button to obtain the form and open it in a suitable editor.

- Enter your personal information in the designated fields, including your name, address, and Social Security number. Make sure to accurately fill out all required details.

- In the section regarding marital status, select the appropriate option that reflects your current status. This information affects the withholding calculations.

- Provide your withholding exemptions, if applicable. Users should follow the instructions carefully to ensure they claim the correct number of exemptions.

- Review any additional instructions related to unemployment compensation, if relevant to your situation. Ensure you understand any impacts on your withholding.

- Finally, after filling out all sections of the form, ensure all information is accurate and complete. Users can then save changes, download, print, or share the form as needed.

Complete your documents online today to stay informed and prepared for your tax obligations.

The CT W4P form, or Connecticut Employee’s Withholding Certificate for Pension or Annuity Payments, regulates how taxes are withheld from pension or annuity payments in the state. It is crucial for ensuring that the right amount is withheld based on your financial status. Using the 2011 Form W 4p as a guide can help you navigate the withholding process and ensure compliance with state regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.