Loading

Get Irs Form 1277 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 1277 online

Filling out the IRS Form 1277 online can be a straightforward process if you follow each step carefully. This guide provides clear instructions to help you navigate the form efficiently and accurately. Let's ensure you have all the information you need to complete the process smoothly.

Follow the steps to fill out IRS Form 1277 online successfully

- Click ‘Get Form’ button to obtain the form and open it in your browser.

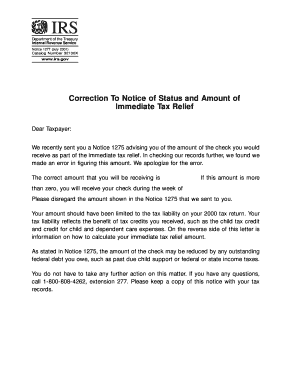

- Review the introduction section of the form, which explains the purpose of the form and the corrections made to previous notices regarding immediate tax relief.

- In the applicable fields, indicate your filing status—options include 'Single', 'Married Filing Separately', 'Head of Household', or 'Married Filing Jointly or Qualifying Widow(er)'. Select the option that pertains to your situation.

- Next, you will need to enter your taxable income. This figure can be found on your Form 1040, line 39; Form 1040A, line 25; or Form 1040EZ, line 6. Ensure the number you enter corresponds accurately to your tax return.

- After entering your taxable income, calculate the amount of immediate tax relief you will receive, using the formulas provided based on your filing status. Note the limits for your check amount as specified: $300, $500, or $600, along with the 5% calculation of your taxable income or your income tax liability.

- Double-check all the information entered for accuracy. If corrections are necessary, make the appropriate adjustments before finalizing the form.

- Once you have completed the form and verified all entries, save your changes. You may also have the option to download, print, or share the completed form, depending on your preferences.

Complete IRS Form 1277 online today to avoid delays in processing your tax relief.

An IRS transcript is a summary of your tax return information, providing a record of your filed taxes. You can request this document online or by filing Form 1277. It is essential for verifying income, especially when applying for loans or other financial services, so understanding how to obtain it is crucial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.