Loading

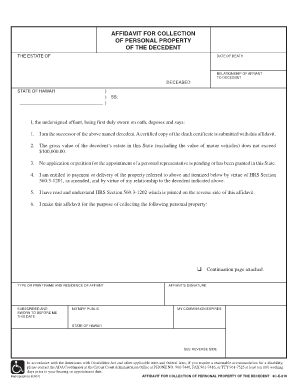

Get Affidavit For Collection Of Personal Property Hawaii

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Affidavit For Collection Of Personal Property Hawaii online

Filling out the Affidavit For Collection Of Personal Property in Hawaii can seem daunting, but this guide simplifies the process. By following these clear steps, you will be able to complete the form accurately and efficiently.

Follow the steps to fill out the Affidavit For Collection Of Personal Property

- Press the ‘Get Form’ button to access the Affidavit For Collection Of Personal Property and open it in your digital editor.

- Begin by entering the name of the decedent in the appropriate field. Ensure that the name matches exactly as it appears on the death certificate.

- Provide the date of death in the designated section. This information is crucial for establishing the timeline for the affidavit.

- Indicate your relationship to the decedent in the specified space. This establishes your legal standing to collect the personal property.

- Include a statement confirming that you are the successor of the decedent in the space provided, and attach a certified copy of the death certificate.

- State the gross value of the decedent’s estate in Hawaii, ensuring that it does not exceed $100,000, as required by law.

- Confirm that no application or petition for the appointment of a personal representative has been filed or granted by marking the relevant box.

- Specify your entitlement to payment or delivery of the property as per HRS Section 560:3-1201 and state how your relationship justifies this entitlement.

- Acknowledge that you have read and understood HRS Section 560:3-1202 by marking or signing in the appropriate section.

- List the personal property you are seeking to collect under this affidavit. If more space is needed, indicate that a continuation page is attached.

- Type or print your name and residence in the designated fields, ensuring all details are clear and accurate.

- Sign the affidavit in the space provided, ensuring to follow any specific instructions regarding the witnessing or notarization of the document.

- Finally, save your changes, and choose to download, print, or share the completed affidavit as needed.

Start filling out your Affidavit For Collection Of Personal Property online today.

An affidavit for collection of personal property in Minnesota is a simplified legal form that allows heirs to gather assets of a deceased person's small estate. This process is less complex than probate, making it quicker and more efficient. If you need assistance, uslegalforms provides reliable templates that can guide you through the creation of this affidavit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.