Loading

Get Mo 1040es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo 1040es online

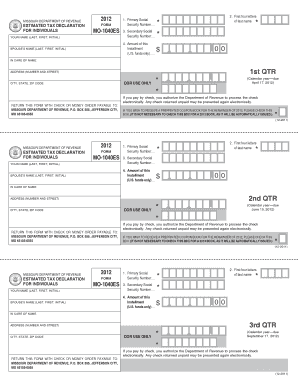

Completing the Mo 1040es form online is a straightforward process that allows users to declare their estimated tax payments for the upcoming year. This guide provides clear instructions tailored to assist all users in navigating the form efficiently.

Follow the steps to complete the Mo 1040es efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the specified format: last name, first name, and middle initial where applicable.

- Provide your primary Social Security number in the designated field.

- For individuals filing jointly, fill in your spouse’s name and Social Security number as required.

- Input the first four letters of your last name using all capital letters in the designated section.

- Fill in the amount of your estimated tax installment as indicated on your estimated tax worksheet.

- Complete your address including the street number, city, state, and ZIP code.

- Review your entries for accuracy and completeness, ensuring that all required fields are filled out.

- Once reviewed, you can save the changes to your form, download it for your records, or print it if you prefer a hard copy.

- Follow any additional instructions for payment or submission as indicated in the form.

Complete your documents online today for a hassle-free filing experience.

Yes, e-filing is available for Missouri taxes, allowing you to submit your MO 1040 electronically. This method tends to be quicker and often provides a confirmation of receipt, giving you peace of mind. Many tax preparation services support Missouri e-filing. Consider using trusted platforms that offer guidance throughout the process for a seamless experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.