Loading

Get Form Rev 419

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Rev 419 online

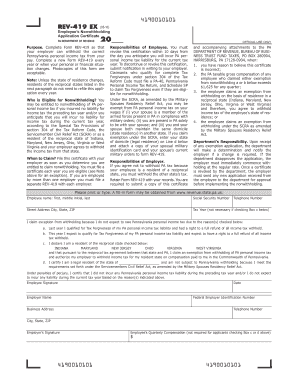

Form Rev 419 is an essential document used to request nonwithholding of Pennsylvania personal income tax. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete your application for nonwithholding

- Press the 'Get Form' button to access the form and open it in the editor.

- Begin filling out the form by entering your full name, including first name, middle initial, and last name, in the designated field.

- Provide your Social Security Number in the appropriate area to ensure proper identification.

- Enter your telephone number, street address, city, state, and ZIP code in the respective fields to ensure your employer can contact you.

- Indicate the tax year at the top (not necessary if choosing Box c) to clarify your filing period.

- Select the appropriate exemption reason by checking the applicable box: a) if you qualified for Tax Forgiveness last year, b) if you expect to qualify this year, or c) if you are a resident of a reciprocal state.

- If you choose Box c, specify your reciprocal state from the list provided (Indiana, Maryland, New Jersey, Ohio, Virginia, or West Virginia) to confirm your exemption.

- Complete line d only if claiming an exemption under the Servicemembers Civil Relief Act by entering your state of domicile.

- Certify that you did not incur any Pennsylvania personal income tax liability during the prior year and/or do not expect to incur any for the current year by signing and dating the form.

- The employer section should be filled out with the employer's name, federal employer identification number, business address, and telephone number, followed by the employer's signature.

- If you are not applying under Box c or d, enter your quarterly compensation in the provided field.

- Once all necessary sections are filled, save your changes, download, print, or share the completed form as per your requirements.

Complete your Form Rev 419 online today to ensure accurate tax withholding from your pay.

Individuals required to file Form 10IEA typically include those working in specific employment scenarios outlined by the state. If you receive income that is subject to withholding, you may need to submit this form along with your Form Rev 419. Always review the filing requirements to confirm your obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.