Get Irs Form 2031

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 2031 online

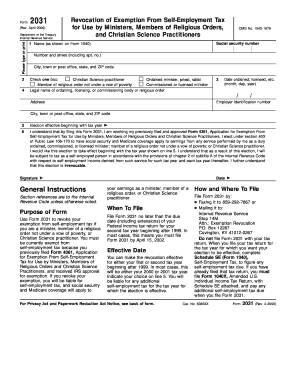

IRS Form 2031 is used by certain religious individuals to revoke their exemption from self-employment tax. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring you have all the necessary information and understand each component required.

Follow the steps to successfully complete the IRS Form 2031 online.

- Press the ‘Get Form’ button to obtain the IRS Form 2031 and open it in a digital editor.

- Enter your social security number in the designated field as it appears on your social security card.

- Fill in your full name as shown on Form 1040 in the first section.

- Select one box to identify your status: Christian Science practitioner, ordained minister, priest, rabbi, or member of a religious order not under a vow of poverty.

- Provide the legal name of the ordaining, licensing, or commissioning body, or religious order, along with their employer identification number (EIN) if applicable.

- Input your address details, including street number, city, state, and ZIP code.

- Mark the date you were ordained, licensed, or began practice in the relevant section.

- Choose the tax year to make the revocation effective by entering the date in the corresponding line.

- Carefully read the paragraph on line 6 and affix your signature and date to validate the form.

- After finishing, save any changes made to the form, and consider downloading or sharing your completed document as needed.

Complete and file your IRS Form 2031 online today to manage your tax obligations effectively.

Net profit or loss is the final financial result after all revenues and expenses are accounted for, directly impacting a business's bottom line. Understanding this metric is crucial for making informed decisions and helps in producing accurate tax returns. When using IRS Form 2031, being aware of your net profit or loss informs your tax obligations more precisely. This comprehension ultimately promotes better financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.