Loading

Get Irs Form 14134

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 14134 online

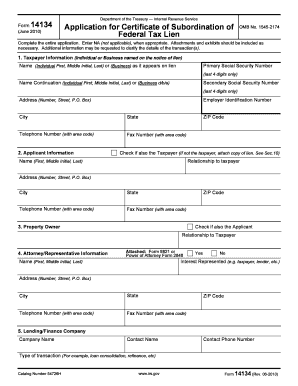

Filling out the IRS Form 14134, which is the application for a certificate of subordination of federal tax lien, can be an important step for individuals and businesses dealing with tax liens. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to accurately fill out the form online.

- Press the 'Get Form' button to access the IRS Form 14134 online and open it in the editor.

- Begin with the taxpayer information section. Provide the name of the individual or business as it appears on the lien, including their primary social security number (last 4 digits only), address, and telephone number.

- Complete the applicant information section. If you are the taxpayer, check the appropriate box. Otherwise, provide your name, relationship to the taxpayer, and contact details.

- Fill in the property owner details. If you are also the applicant, check the box to indicate this.

- Provide the attorney or representative information if applicable. Include the name, interest represented, and contact details. Attach necessary forms such as Form 8821 or Power of Attorney Form 2848.

- In the lending/finance company section, provide the company name, contact name, phone number, and type of transaction related to the application.

- Enter the monetary information. Detail the existing loan amount, new loan amount, and amount to be paid to the United States if applicable.

- Identify the basis for subordination by checking the appropriate box and providing necessary explanations or statements as required.

- Describe the property for which subordination is being requested. Provide the property address and attach copies of necessary documents such as deeds or titles.

- If applicable, complete the appraisal and valuation section and provide documentation to support your submission.

- Provide a copy of the federal tax lien if the applicant and taxpayer differ. List lien numbers if known.

- Attach a proposed loan agreement if available and provide a description of how subordination is in the best interests of the United States.

- Include a copy of a current title report and list any encumbrances senior to the federal tax lien.

- Itemize all proposed costs, commissions, and expenses associated with the property transfer or sale.

- Complete the declaration section, ensuring to sign and date the application to certify its accuracy before submission.

- Once all sections are completed, you can save changes, download, print, or share the form as necessary.

Get started on completing your IRS Form 14134 online today.

Related links form

You can get IRS information by visiting the IRS website, where a wealth of resources is available for taxpayers. Additionally, you can contact the IRS through their helpline for direct inquiries. For a more organized and professional approach, consider using US Legal Forms to access accurate forms and reliable guidance related to IRS matters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.