Loading

Get Nc5x 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nc5x online

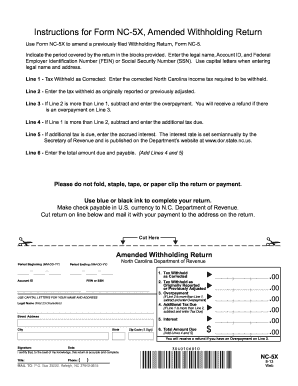

The Nc5x form is used to amend a previously filed Withholding Return, allowing users to correct any discrepancies. This guide provides a clear step-by-step process for filling out the form online, ensuring accuracy and compliance with North Carolina tax regulations.

Follow the steps to complete the Nc5x online conveniently.

- Press the ‘Get Form’ button to access the Nc5x form and open it in your preferred editor.

- Indicate the period covered by the return in the designated blocks strongly recommended for clarity.

- Enter your legal name in capital letters in the relevant field, followed by your Account ID.

- Input your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as applicable.

- For Line 1, provide the corrected amount of North Carolina income tax withheld.

- On Line 2, enter the tax withheld as it was originally reported or previously adjusted.

- If Line 2 exceeds Line 1, subtract Line 1 from Line 2 to determine and enter any overpayment on Line 3. This may result in a refund.

- If Line 1 is greater than Line 2, subtract Line 2 from Line 1 for Line 4 to ascertain any additional tax due.

- If additional tax is due, calculate the accrued interest for Line 5, noting that the interest rate is published by the Secretary of Revenue.

- Line 6 requires you to sum the amounts from Lines 4 and 5 to determine the total amount due.

- Certainly, avoid folding, stapling, taping, or using paper clips on the return or payment.

- Complete your return using blue or black ink for clarity and legibility.

- For payment, make checks payable in U.S. currency to the N.C. Department of Revenue.

- Cut the return where indicated and send it along with your payment to the specified address.

Start filling out your Nc5x today to ensure correct tax withholding amendments.

No, the NC-5Q cannot be filed online at this time. You need to print and mail the form after filling it out. However, using tools like US Legal Forms can simplify the preparation, ensuring you have everything in order before sending it off.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.