Loading

Get Obee Credit Union Reviews

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Obee Credit Union Reviews online

Completing the Obee Credit Union Reviews online is a straightforward process that allows users to provide valuable feedback. By following the steps outlined below, you can efficiently fill out the necessary information to ensure your review is submitted correctly.

Follow the steps to fill out the Obee Credit Union Reviews online

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

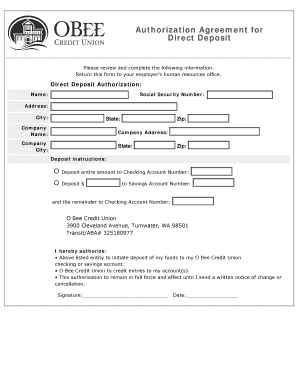

- Begin by entering your personal information in the designated fields, including your name, Social Security number, address, city, state, and zip code. Ensure that all information is accurate to avoid any delays in processing.

- Next, provide your employer's information by filling out the company name, company address, company city, state, and zip code. This section is essential as it links your direct deposit authorization to your employer.

- For the deposit instructions, indicate your preferences for the allocation of funds. Specify the entire amount to be deposited into your checking account number. If you wish to deposit a portion into a savings account, state the amount alongside the savings account number, and indicate where the remainder should go.

- Read through the authorization statement carefully. This section confirms that you allow the designated entity to initiate deposits into your Obee Credit Union account and that this authorization will remain effective until you provide written notice of any changes.

- Finally, sign and date the form where indicated. Your signature serves as a validation of the information provided and your consent to the terms.

- Once completed, review the form for any inaccuracies. You can then save your changes, download, print, or share the completed form as required.

Take a moment to fill out the Obee Credit Union Reviews online to share your experience!

Just like banks, credit unions are federally insured; however, credit unions are not insured by the Federal Deposit Insurance Corporation (FDIC). Instead, the National Credit Union Administration (NCUA) is the federal insurer of credit unions, making them just as safe as traditional banks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.