Get Wage Loss Verification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wage Loss Verification Form online

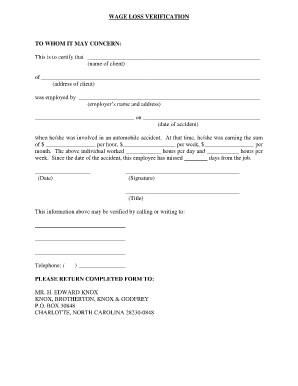

Filling out the Wage Loss Verification Form is an essential step in documenting lost wages due to an automobile accident. This guide provides clear and concise instructions for completing the form online, ensuring that users can accurately report their information.

Follow the steps to accurately complete your form

- Press the ‘Get Form’ button to access the Wage Loss Verification Form and open it for editing.

- In the first section, enter the full name of the individual who is verifying wage loss in the field labeled 'name of client'.

- Next, fill in the 'address of client' section with the complete mailing address of the individual.

- Provide the employer's name and their complete address in the designated fields.

- Indicate the date of the accident by filling in the 'date of accident' field.

- In the following fields, specify the hourly, weekly, and monthly earnings of the individual prior to the accident.

- Document the number of hours worked per day and per week in the respective sections as required.

- Record the total number of days the employee has missed from work since the accident.

- Include the date of completion and affix the signature, along with the title of the individual completing the form.

- Finally, ensure all information is accurate and complete before you save, download, print, or share the form as needed.

Complete your Wage Loss Verification Form online today to ensure timely processing of your claim.

When writing a letter of verification, start with a formal introduction. Clearly state your intention to confirm specific facts about the individual, providing pertinent details such as their employment status or relationship to you. Remember to include a closing statement that encourages further questions if needed. If verifying lost wages, consider using a Wage Loss Verification Form to ensure you provide all required information clearly and concisely.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.