Loading

Get Neap Benefits

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Neap Benefits online

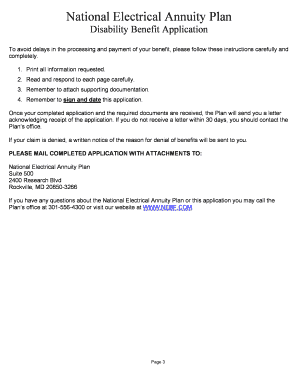

Filling out the Neap Benefits application online is crucial for those seeking benefits under the National Electrical Annuity Plan. This guide provides a step-by-step approach to ensure that you complete the application accurately and effectively.

Follow the steps to complete your Neap Benefits application online.

- Click ‘Get Form’ button to obtain the Neap Benefits application and open it in the editing platform.

- Fill in the NEAP participant's information, including their Social Security Number, full name, date of birth, current mailing address, and telephone number. Make sure all information is accurate and printed clearly.

- In the 'Proof of Age' section, review the documentation requirements. Provide the best proof of age, either one document from the Primary Proof list or two from the Secondary Proof list. Ensure to include any necessary documentation for name changes if applicable.

- Complete the sections regarding previous marriages. If previously married, list all spouse information, including names, dates of marriage, and reasons for the end of marriage.

- Describe your disability briefly and include any supporting documentation as requested in the relevant section of the form.

- Provide details about your last NEAP employer, including their mailing address, your home local union number, and your last day worked.

- Select your preferred benefit option between lump-sum payments and periodic payments. Follow the specific instructions regarding your selections, including any necessary consents if married.

- Complete the Employer’s Rollover Authorization if applicable, providing the necessary trustee information.

- Ensure that all required documents are compiled, including copies of the Social Security card, birth certificate, and any marriage or divorce documentation.

- Lastly, sign and date the application. Review the form to ensure accuracy, save your changes, and then download or print the application for submission.

Complete your Neap Benefits application online to ensure your benefits processing is timely and accurate.

The Neap Benefits fund invests in a diversified portfolio that typically includes stocks, bonds, and other financial instruments. This diversified approach aims to maximize returns while managing risks. By understanding these investment strategies, you can gain insight into how your future Neap Benefits might grow.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.