Loading

Get Etrade W8ben

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Etrade W8ben online

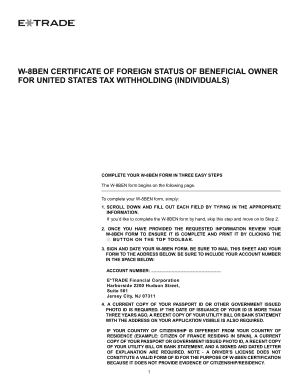

Completing the Etrade W8ben form online is essential for individuals seeking to establish their foreign status for U.S. tax withholding purposes. This guide will provide you with step-by-step instructions to navigate through each section of the form effectively.

Follow the steps to complete your Etrade W8ben form online

- Click 'Get Form' button to access the W8ben document and open it in your preferred editor.

- Begin by entering your full name in the designated field for the beneficial owner. Ensure accuracy to avoid delays.

- Fill out your permanent residence address completely, including street, city or town, state or province, and postal code. Avoid using a P.O. box or in-care-of address.

- Indicate your country of citizenship in the relevant field.

- Provide your mailing address, if it differs from your permanent residence, ensuring all necessary details are included.

- Input your U.S. taxpayer identification number, such as a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), if applicable.

- Fill in your foreign tax identifying number, if required, along with your date of birth formatted as MM-DD-YYYY.

- If eligible, complete the claim of tax treaty benefits section, stating your country and the treaty provisions you are relying upon.

- Review all the information you've provided for completeness and accuracy to ensure there are no mistakes.

- Once confirmed, print your W8ben form by selecting the appropriate button on the top toolbar to have a physical copy.

- Sign and date your W8ben form before mailing it to E*TRADE Securities LLC at the address provided, ensuring you include your account number.

Complete your Etrade W8ben form online today and ensure your tax status is correctly documented.

If you are a business or entity, you should complete a W-8BEN-E form instead of the individual version. This form helps entities claim tax treaty benefits and assert their foreign status. Always check the IRS guidelines to determine which form suits your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.