Loading

Get Arizona Form 650a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form 650a online

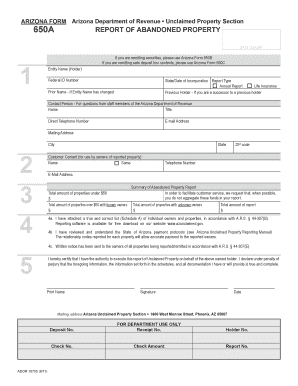

Filling out the Arizona Form 650a can be a straightforward process when approached step by step. This guide will assist you in accurately completing the abandoned property report online, ensuring that you meet the necessary requirements set forth by the Arizona Department of Revenue.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and access it in your online editor.

- Enter the entity name in the designated field. This should be the name of the holder. Additionally, input the federal ID number and state/date of incorporation.

- Select the report type from the options provided, such as Annual Report or Life Insurance. If applicable, include details about the previous holder or the prior name if the entity name has changed.

- Provide contact details for the person designated to respond to queries. This includes their title, name, direct telephone number, and email address.

- Fill in the mailing address, including city, state, and ZIP code.

- Next, complete the summary of abandoned property report. Specify amounts for properties under $50, properties over $50 with known owners, and properties with unknown owners. Finally, calculate the total amount of the report.

- Certify your report by confirming that you have attached a true and correct list of individual owners and properties. Agree to understand payment protocols for unclaimed property.

- Indicate that written notice has been sent to the owners of properties being reported as required by Arizona law.

- At the bottom of the form, provide your printed name, signature, and the date to certify the information provided is true and complete.

- Once finished, you can save your changes, download, print, or share the completed form as needed.

Begin the process of completing your Arizona Form 650a online today.

The property tax credit form in Arizona is established to provide financial relief to eligible homeowners. This form is essential for applying for tax credits that can significantly reduce your tax burden. Completing the Arizona Form 650a accurately will help ensure you receive the credits you're entitled to. At uslegalforms, you can find resources to guide you through the application process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.