Loading

Get Tmse Oregon Department Of Revenue 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Tmse Oregon Department Of Revenue online

Filling out the Tmse Oregon Department Of Revenue form can seem daunting, but this guide will walk you through each section step-by-step. With clear instructions, you will be able to complete the form accurately and efficiently.

Follow the steps to complete your form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

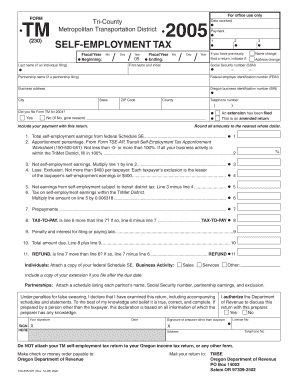

- Begin by filling in your name, address, telephone number, and Social Security number in the name and address section. Ensure all details are accurate to avoid processing errors.

- Enter your total self-employment earnings as reported on your federal Schedule SE on line 1. If you have multiple business activities, compute the earnings separately for each.

- Complete line 2 by applying the appropriate apportionment percentage, either 100% or based on your business activity, which involves using Form TSE-AP if applicable.

- Subtract any exclusion amount, not exceeding $400, from your self-employment earnings on line 4.

- Calculate your net self-employment earnings by subtracting line 4 from line 3 and enter this amount on line 5.

- Multiply the amount on line 5 by 0.006318 to find the tax amount on your self-employment earnings within the TriMet District on line 6.

- Add any prepayments made on line 7, then calculate your total tax to pay by subtracting line 7 from line 6 on line 8.

- If applicable, calculate any penalty and interest for late filing or payment on line 9 and then add this to the tax due on line 10.

- Before mailing, ensure to sign and date your return and include a copy of your federal Schedule SE, as well as any necessary documentation for a partnership return.

- Finally, save your completed form, and decide whether to download, print, or share it before mailing it to the Oregon Department of Revenue at the specified address.

Complete your documents online today for a hassle-free filing experience.

If the Oregon Department of Revenue calls you, it may be regarding questions about your tax filings or to discuss a recent correspondence. They may also be following up on outstanding tax obligations or seeking clarification on your identity and account. To handle these calls effectively, consider the insights from Tmse Oregon Department Of Revenue to stay informed and prepared when communicating with them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.