Loading

Get Credit Investigation Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Investigation Form online

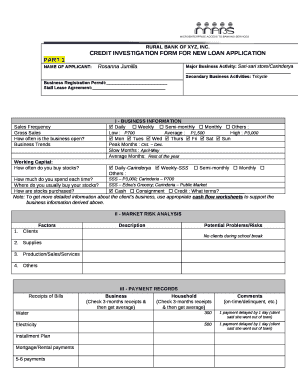

Filling out the Credit Investigation Form online is a crucial step in applying for a loan. This guide provides a comprehensive overview of each section and field of the form to assist users in accurately completing their application.

Follow the steps to effectively complete the Credit Investigation Form online.

- Click ‘Get Form’ button to obtain the form and open it in the designated online platform.

- In Part 1, enter the name of the applicant in the designated field. Include business activities, such as primary and secondary activities. Fill in details about business registration and lease agreements.

- Indicate the sales frequency and total gross sales. Select how often the business is open and enter information about working capital and purchase frequency.

- In the Market Risk Analysis section, assess potential problems or risks related to clients, supplies, production, and other factors.

- Complete the Payment Records part, documenting both business and household payment history. Check receipts for accurate average amounts and comment on payment punctuality.

- For the Inventory of Business Assets section, list assets with descriptions, quantities, and approximate values. Ensure that all entries are accurate and complete.

- In the Merchandise Inventory part, list the five fastest-selling or largest items, detailing their unit costs and estimated values. Ensure calculations are correct.

- Similar to business assets, complete the Inventory of Personal Assets section with detailed descriptions and values of personal property.

- Fill out the Balance Sheet, summarizing total assets and liabilities. Ensure that net worth calculations are accurate.

- In Part 2, conduct interviews with character references, creditors, and suppliers, indicating their relationship with the applicant. Collect comprehensive information regarding payment habits.

- Complete the Character and Risk Analysis checklist, marking indicators related to stability, entrepreneurship, reputation, and repayment behavior.

- Address any red flags identified during the assessment and document cash flow analysis, making sure to analyze the applicant's debt capacity.

- Conclude with the recommended course of action based on the analysis, summarizing findings clearly and offering any necessary recommendations.

- Once all fields are completed, save changes, and utilize options to download, print, or share the completed form as needed.

You can complete your application by filling out the Credit Investigation Form online today.

During a credit card investigation, authorities or financial institutions review your credit usage and payment history to identify any issues. This process can include validating transactions and assessing your financial behavior. Often, a Credit Investigation Form is involved to authorize this type of review.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.