Loading

Get Ia 706 Fillable Form Schedule J 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 706 Fillable Form Schedule J online

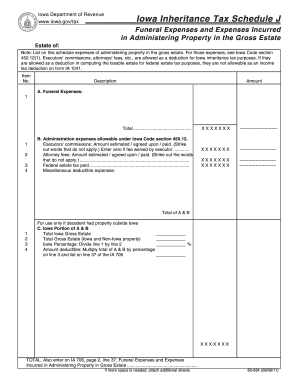

Filling out the Ia 706 Fillable Form Schedule J is an important step in managing funeral and administration expenses for an estate. This guide will provide clear, step-by-step instructions to help users effectively complete the form online.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access the Ia 706 Fillable Form Schedule J and open it in your preferred format.

- In the section labeled ‘A. Funeral Expenses’, enter details of all funeral expenses incurred. Make sure to fill in the total at the designated space.

- Under section ‘B. Administration expenses allowable under Iowa Code section 450.12’, input the executors’ commissions. Indicate the amount estimated, agreed upon, or paid, striking out the options that do not apply. If the fee was waived, enter zero.

- Next, provide the attorney fees in the same manner as the executors’ commissions. Again, strike out the options that do not pertain to your situation.

- Document any federal estate tax paid in the specified area of section B.

- Record any miscellaneous deductible expenses that are applicable, ensuring to provide details for each item.

- Calculate the total for sections A and B, and input this value in the designated ‘Total of A & B’ area.

- If the decedent had property outside Iowa, complete section C by calculating the Iowa portion of the total expenses. Divide total line amounts as instructed.

- Multiply the total from A & B by the Iowa percentage calculated in section C to find the deductible amount, which should be recorded in line 37 of the IA 706.

- Finally, review all entries for accuracy, and then you can either save changes, download, print, or share the completed form as needed.

Complete your Ia 706 Fillable Form Schedule J online now for efficient estate management.

The 706 form is primarily used for reporting estate taxes to the IRS. It is crucial for estates exceeding certain value thresholds, as it determines tax liabilities. If you find yourself managing estate affairs, the Ia 706 Fillable Form Schedule J can serve as an essential tool in the filing process. By using platforms like uslegalforms, you can ensure your form is completed accurately and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.