Loading

Get 1091 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1091 Form online

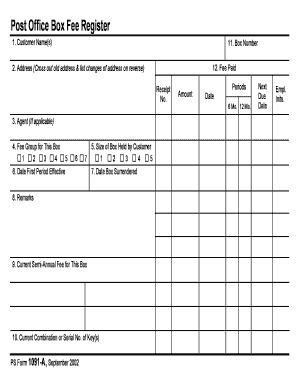

Filling out the 1091 Form online is a straightforward process that allows you to register for a post office box. This guide will provide step-by-step instructions to help you complete each section of the form with ease.

Follow the steps to complete the 1091 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the customer name(s) in the designated field. Ensure accurate spelling and correct formatting.

- Provide the address. If you have a previous address, remember to cross it out and list any changes on the reverse side of the form.

- If applicable, specify the agent's name in the agent field.

- Select the fee group for your box by marking the appropriate option (1-4).

- Indicate the size of the box held by you by selecting one of the options (1-5).

- Fill in the date of the first period that the box became effective.

- If applicable, enter the date the box was surrendered.

- Provide any remarks or notes as necessary.

- Enter the current semi-annual fee for the box.

- List the current combination or serial number of the key(s).

- Review all entered information for accuracy and completeness. Save your changes, then download, print, or share the form as needed.

Complete your documents online today for a seamless experience.

The 1091 Form is a structured document used for various tax-related purposes, primarily within the United States tax system. This form can be critical for people involved in agricultural operations, as it provides necessary information for tax exemptions or deductions. To ensure you complete the 1091 Form accurately, consider the resources available on uslegalforms, helping you file with confidence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.