Loading

Get Verification Of Non Filing Letter 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Verification Of Non Filing Letter online

The Verification Of Non Filing Letter is a critical document for individuals who need to confirm that they did not file a tax return for a specific year. This guide will walk you through the process of obtaining this letter online, step by step.

Follow the steps to successfully complete the Verification Of Non Filing Letter online.

- Click the ‘Get Form’ button to access the Verification Of Non Filing Letter and open it in your preferred online editor.

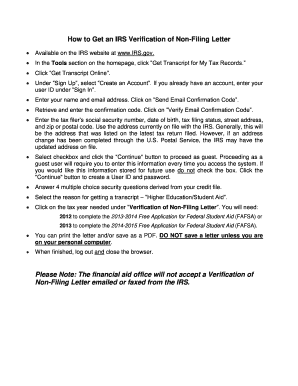

- Navigate to the tools section on the homepage of the IRS website. Locate and select ‘Get Transcript for My Tax Records’ to begin the process.

- Choose ‘Get Transcript Online’ to initiate the online procedure for obtaining your letter.

- Under the ‘Sign Up’ option, select ‘Create an Account’ if you’re a new user, or enter your user ID to ‘Sign In’ if you already have an account established.

- Input your name and email address. Then, press ‘Send Email Confirmation Code’ to receive a verification code.

- Check your email for the confirmation code, enter it in the designated field, and click ‘Verify Email Confirmation Code’ to proceed.

- Provide the tax filer’s social security number, date of birth, tax filing status, street address, and zip or postal code. Ensure that you use the address currently on file with the IRS.

- Select the checkbox to proceed as a guest or avoid checking it if you wish to store this information for future access. Click the ‘Continue’ button to move forward.

- Answer the four multiple choice security questions based on your credit file to verify your identity.

- Indicate the reason for requesting the transcript by selecting ‘Higher Education/Student Aid’.

- Choose the appropriate tax year needed under ‘Verification of Non-Filing Letter’ for your FAFSA submission.

- Once your letter is generated, you can either print it or save it as a PDF. Remember to only save the document on a personal computer.

- After you are finished, ensure you log out and close the browser for security.

Complete your Verification Of Non Filing Letter online today to ensure all your documentation needs are met efficiently.

When the IRS sends you a verification letter, it usually indicates that they need to verify your tax status or that you have unresolved tax matters. This letter serves as a prompt to ensure you are compliant with your tax obligations. Responding quickly can help you resolve any issues and avoid further complications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.