Loading

Get Group Loan Application Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Group Loan Application Form online

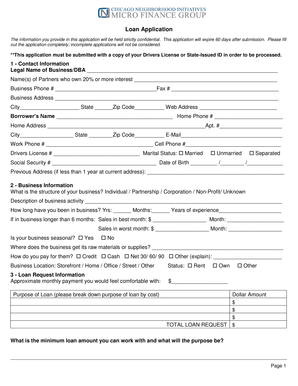

Filling out the Group Loan Application Form online can be straightforward when you understand each component. This guide will provide you with clear, step-by-step instructions to ensure a smooth application process.

Follow the steps to complete the application effectively.

- Click ‘Get Form’ button to access the application form and open it in your online editor.

- Begin with the contact information section. Fill in the legal name of your business or DBA, names of partners holding 20% or more interest, contact numbers, business address, and email. Make sure to include the social security number and driver’s license number of the borrower.

- Proceed to the business information section. Provide details regarding the structure of your business, describe your business activity, and the duration it has been operational. Include sales figures for the best and worst months, along with how you procure your raw materials.

- In the loan request information section, indicate your desired approximate monthly payment as well as the purpose of the loan with a breakdown of associated costs.

- Input your landlord information if applicable. This includes housing status, information about your current landlord, and the duration of residency.

- Fill out the employment information section if you are employed. Include your employer's details, job title, and how long you have been working there.

- Provide comprehensive financial information. List your business assets and liabilities, detailing each item’s description, estimated value, and associated monthly payments.

- Complete the co-borrower’s information section by adding details of any business partners owning at least 20% of the business or spouses who may be co-borrowers.

- Fill out the bank account information section, indicating the type of accounts you possess.

- Provide your credit information, including details regarding any previous bankruptcies or current financial obligations like taxes.

- Complete the socio-economic information section where you may share details about your education and household status.

- Fill in the referral information and business references section, ensuring you provide accurate and verifiable contact details.

- Finally, review the application for completeness and accuracy, then save the changes. You can choose to download, print, or share the form as needed.

Begin filling out your Group Loan Application Form online today to take the first step towards securing your loan.

Yes, intercompany loans must be repaid unless otherwise agreed upon. These loans often come with formal agreements specifying repayment terms and interest provisions. Ensuring clarity in the loan documentation is crucial to avoid disputes later on. A Group Loan Application Form can help align expectations between companies regarding repayment responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.