Loading

Get Iht205 Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht205 Pdf online

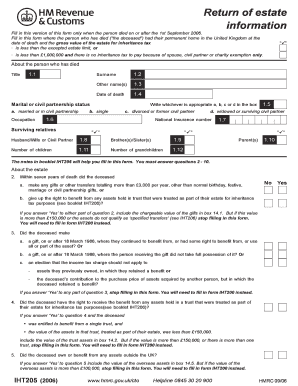

The Iht205 Pdf is a vital document for individuals settling estates when the deceased's estate falls below the excepted limit. This guide will help you navigate the process of completing this form online with clear, step-by-step instructions tailored to your needs.

Follow the steps to successfully complete the Iht205 Pdf online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Fill in section 1 about the deceased. Provide their title, surname, other names, date of death, marital or civil partnership status, and National Insurance number. Be attentive to detail, ensuring each entry is accurate.

- In section 2, answer questions related to gifts or transfers the deceased made within seven years preceding their death. Note if any gifts exceed the specified limits, as this may require transitioning to form IHT200.

- Complete section 3 regarding any gifts made on or after 18 March 1986 where the deceased retained a benefit. If applicable, stop filling out the form and switch to IHT200.

- In section 4, indicate if the deceased had rights to any assets held in trust. If the value exceeds £150,000, switch to form IHT200.

- Proceed to section 5 and note any assets owned or benefited from outside the UK. Again, if the value surpasses £100,000, you must transition to form IHT200.

- Continue filling out questions 6 to 12, noting if the deceased had life insurance policies or pension benefits that require additional documentation or switch to form IHT200.

- In section 13, list the deceased's assets, such as cash, property, and any investments, providing their gross values without exemptions. Use estimates where necessary and indicate as such.

- Enter total amounts in section 14 and ensure all components, including additional gifts, trusts, or overseas assets, are documented properly.

- Fill in any debts related to the estate in section 15. Make sure to include funeral expenses, mortgages, and other liabilities accurately.

- In section 16, if applicable, provide any extra information that may affect the assessment of the estate.

- Finally, review your entries for completeness and accuracy before saving changes. Download or print the completed form as needed for submission.

Complete your Iht205 Pdf online now to ensure a smooth handling of the estate.

An IHT207 is a form used to report the value of an estate that does not qualify for the full inheritance tax threshold, specifically when the estate is straightforward without complex financial elements. This form complements the Iht205 Pdf, guiding you step by step through the process of reporting and managing simple estates, ensuring compliance while facilitating smooth administration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.