Loading

Get Small Business Credit Application - Rcu 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Small Business Credit Application - Rcu online

Completing the Small Business Credit Application is an important step for businesses seeking financial assistance. This guide will walk you through each section of the application, providing clear and detailed instructions to ensure a smooth online experience.

Follow the steps to complete your application successfully.

- Begin by pressing the ‘Get Form’ button to access the Small Business Credit Application. This will allow you to open the form in the online editor.

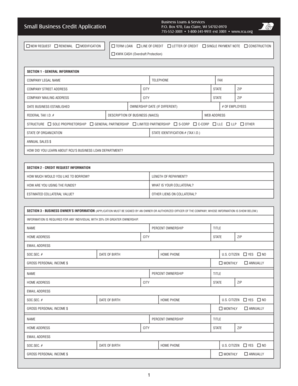

- Fill in Section 1 - General Information: Provide your company’s legal name, street address, mailing address, telephone, fax, and email information. Include your federal tax identification number, company structure, number of employees, ownership date, business establishment date, and a brief description of your business. Make sure to specify how you learned about RCU's business loan department.

- Move to Section 2 - Credit Request Information: Input the amount you wish to borrow, the desired length of repayment, and how you plan to use the funds. Additionally, indicate the collateral you are providing and its estimated value, along with any other liens on that collateral.

- Proceed to Section 3 - Business Owner’s Information: Include required information for any individual with 20% or greater ownership of the business. This includes the owner's name, percentage of ownership, home address, title, email, social security number, citizenship status, home phone, date of birth, and gross personal income.

- In Section 4 - Outstanding Business Loans, list details for up to three lenders you currently have loans with, including the lender name, type of loan, original balance or credit limit, origination date, current balance, monthly payment, and what the loan is secured by.

- Fill out Section 5 - Other Information: Answer questions regarding any losses incurred by the business in the last three years, any unresolved lawsuits, bankruptcies filed, tax obligations, changes in ownership, and collateral pledged by individuals other than the business owner.

- In Section 6 - Other Deposits or Loans of Company/Owners, provide information on financial institutions and services where you hold deposits or loans, along with their balances.

- Finally, complete Section 7 - Legal Copy and Signature: Ensure that the application is signed by an owner or an authorized officer. Verify that the provided information is accurate and complete, and answer the question regarding community property states, if relevant.

- After reviewing your application for accuracy, you may save the changes, download, print, or share the completed form as needed.

Take the next step towards securing funding by completing your Small Business Credit Application online.

Filling out a credit card form involves providing essential information such as your business name, address, the owner's details, and financial information. Be sure to check for accuracy and completeness, as mistakes can delay the application process. Using a standardized approach, like the Small Business Credit Application - Rcu, can significantly simplify this task.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.