Loading

Get Form It710 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form It710 online

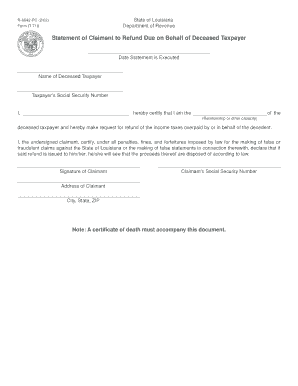

This guide provides users with a clear pathway to successfully complete the Form It710 online, allowing for a refund request on behalf of a deceased taxpayer. Follow the outlined steps to ensure you fill out each section accurately and efficiently.

Follow the steps to effectively complete the Form It710 online

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Begin by entering the date on which the statement is executed, ensuring it reflects the correct day, month, and year.

- In the ‘Name of Deceased Taxpayer’ field, write the full name of the individual for whom the refund is requested.

- Provide the taxpayer’s Social Security Number accurately to avoid processing delays.

- In the blank space provided, fill in your full name and declare your relationship or other capacity to the deceased taxpayer.

- Carefully read the certification statement and ensure you understand the penalties for making false claims.

- Sign the document in the designated area to validate your request.

- Enter your own Social Security Number and address, including city, state, and ZIP code.

- Before submission, remember to attach the required certificate of death to this document.

- Review all entries for accuracy, then save your changes, download a copy, print, or share the completed form as needed.

Fill out your Form It710 online today and ensure a smooth refund process.

Several factors may trigger an FBAR audit, such as reporting suspicious activity or discrepancies in your financial records. High-value transactions and failure to disclose various accounts are also common red flags. It’s essential to keep accurate records and report any necessary information. Using services like US Legal Forms can help ensure compliance with your Form It710 submissions to minimize audit risks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.