Get Sample Completed Irs Form 4684

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Sample Completed IRS Form 4684 online

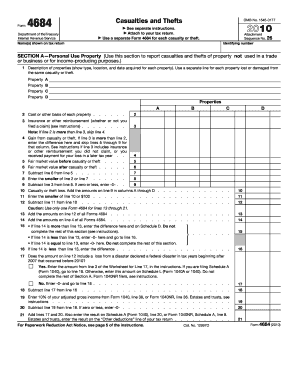

This guide provides comprehensive instructions on how to fill out the Sample Completed IRS Form 4684 online. Designed for ease of understanding, it will walk you through each section and field of the form, ensuring you have the knowledge needed to complete it accurately and efficiently.

Follow the steps to fill out the Sample Completed IRS Form 4684 online

- Press the ‘Get Form’ button to acquire the form and open it in the editor.

- In Section A, list the names shown on your tax return along with your identifying number.

- For each property damaged or lost, provide a description in the corresponding lines (A, B, C, D), including its type, location, and acquisition date.

- Enter the cost or other basis of each property in the second column next to the property descriptions.

- Input any insurance or reimbursement amounts you received for the loss in the next available field.

- If your cost basis exceeds your reimbursement, continue to fill in the following fields. If not, skip to the final calculations.

- Calculate and enter the fair market values before and after the casualty or theft in the designated fields.

- Subtract the post-casualty fair market value from the pre-casualty value to determine your loss.

- Using previous entries, calculate your casualty or theft loss and determine the insurance or reimbursement impact.

- Proceed to Section B if applicable, or finalize your entries by reviewing all amounts calculated in previous sections.

- Once all fields are filled in correctly, save your changes, download, print, or share the completed form as needed.

Start filling out your documents online today!

Filling out IRS Form 4684 involves several steps, starting with gathering all necessary information about your property and the specifics of the loss. You will need to provide details such as the date of loss, type of property, and the loss amount calculated according to IRS guidelines. A Sample Completed IRS Form 4684 can serve as an invaluable reference, as it illustrates how to complete each section accurately. If you encounter complexities, consider using US Legal Forms for comprehensive templates and resources to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.