Loading

Get 1003 Re Application.doc 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1003 RE Application.doc online

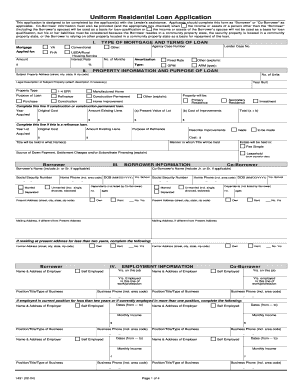

The 1003 RE Application is a vital document for those seeking a residential mortgage. This guide provides clear, step-by-step instructions to help users navigate the process of completing the application online effectively.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to obtain the application and open it in your preferred online editor.

- Begin by selecting the type of mortgage you are applying for, such as VA, FHA, Conventional, or USDA/Rural Housing Service, and fill in the corresponding interest rate and loan amount.

- Next, provide the property information, including the subject property address, the number of units, and the year built. Indicate the purpose of the loan and how the property will be used, such as primary residence, secondary residence, or investment.

- Fill in borrower and co-borrower information. This includes names, social security numbers, dates of birth, employment information, and present addresses.

- Indicate monthly income sources and provide details on assets and liabilities, ensuring to include any joint assets or liabilities if applicable.

- Complete the details of the transaction, such as the purchase price and any expected alterations or improvements.

- Answer all declarations truthfully, as this section addresses potential financial liabilities and legal matters.

- Review all entered information for accuracy before finalizing your application. Ensure you have signed the acknowledgment and agreement section.

- Finally, save your changes in the online editor. You may also download, print, or share the completed application as needed.

Complete your 1003 RE Application online today to start your mortgage application process.

A MISMO 3.4 file refers to a data format used in the mortgage industry for exchanging information. This format adheres to standards set by the Mortgage Industry Standards Maintenance Organization (MISMO). It typically consists of data that can easily be processed, leading to efficiency in mortgage transactions. Often, lenders use the 1003 RE Application.doc to gather this data before converting it into a MISMO compliant file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.