Loading

Get Form 8505 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8508 online

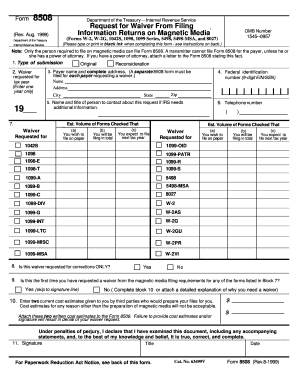

Form 8508 is used to request a waiver from filing certain information returns on magnetic media. This guide provides a clear and detailed process to help you successfully complete and submit this form online.

Follow the steps to fill out Form 8508 online efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the available online editor.

- Select the type of submission by checking the appropriate box for either 'Original' or 'Reconsideration' in Block 1.

- Enter the tax year for which you are requesting the waiver in Block 2. Note that you can only enter one year.

- Provide the payer's name and complete address in Block 3. A separate Form 8508 is needed for each payer asking for a waiver.

- Fill in the Federal Identification number (EIN/SSN) for the payer in Block 4. Ensure this number has 9 digits.

- Enter the name, title, and telephone number of the contact person about this request in Blocks 5 and 6.

- In Block 7, check the applicable boxes for the forms you are requesting a waiver for, ensuring to specify the volume for each form in the corresponding sections.

- Indicate if this waiver is requested for corrections only in Block 8, and provide necessary explanations in Block 10 if applicable.

- Complete Block 10 by entering cost estimates from two service bureaus, as these must be included; attach the estimates to the form.

- Verify that you have signed and dated the form in Block 11, as this is critical for processing your request.

- Once completed, you can save the changes, download a copy, print it, or share the form with the necessary parties.

Begin completing your Form 8508 online today to ensure your request is submitted on time.

Filing Form 8804 late can lead to penalties, which increase the longer the form remains unfiled. The IRS establishes these penalties to encourage timely compliance with tax obligations. To mitigate your risks, ensure that all required forms, including Form 8505, are submitted promptly. Resources like US Legal Forms can assist you in meeting these deadlines effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.