Get 8849 Schedule 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8849 Schedule 2 online

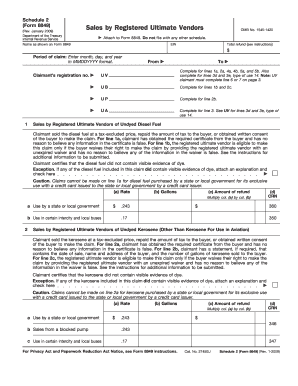

This guide provides clear and comprehensive instructions on filling out the 8849 Schedule 2 form online. Designed for registered ultimate vendors seeking a tax refund, it outlines each section and field of the form to facilitate a smooth filing process.

Follow the steps to successfully complete the 8849 Schedule 2 form online.

- Click ‘Get Form’ button to obtain the form and access it in your online document editor.

- Enter your name as it appears on Form 8849 and provide your Employer Identification Number (EIN) in the designated fields at the top of the form.

- In the 'Total refund' section, input the total amount you are claiming for the refund based on your calculations.

- Complete the 'Period of claim' field by entering the dates in MMDDYYYY format, indicating the start and end dates for the claim period.

- Fill in 'Claimant's registration number', ensuring it matches the number provided by the IRS registration letter.

- Proceed to section lines 1a, 2a, 4a, 4b, 5a, and 5b, and fill out the required information as applicable based on your sales claims.

- Complete any additional lines such as 1b and 2c for eligible sales by registered vendors of undyed diesel fuel or kerosene.

- Review and verify that all required certificates or waivers have been obtained, as specified for each line of the form.

- Confirm the total refund amount by summing the amounts in the refund column for all completed sections of the form.

- Save your changes to the form, and you may choose to download a copy, print a physical copy, or share it as needed to finalize your claims.

Complete your 8849 Schedule 2 form and file your claims online today!

In Canada, the term 'Schedule 3' generally refers to a form related to capital gains or losses. It is used to report the sale of capital property, helping individuals determine their tax implications. While this is not directly related to the U.S. system, understanding its function can provide valuable context. If you are looking for guidance on capital gains in the U.S., consider reviewing 8849 Schedule 2 for accurate reporting.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.