Loading

Get Form Os 114 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Os 114 online

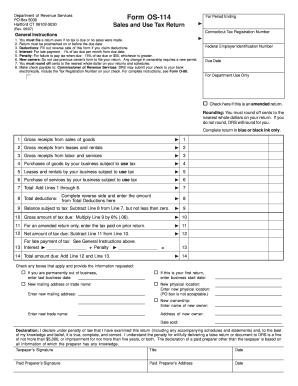

Filling out the Form Os 114 online can streamline the process of submitting your sales and use tax return. This guide provides a clear, step-by-step approach to ensure that you complete the form accurately and efficiently, regardless of your prior experience with legal documentation.

Follow the steps to fill out the Form Os 114 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Connecticut tax registration number in the designated field.

- Indicate the period ending date for the form to reflect the appropriate reporting timeframe.

- Complete the gross receipts sections by providing totals for sales of goods, leases, rentals, and any applicable labor and services.

- If claiming deductions, fill out the reverse side of the form as instructed, and ensure to return to the front to input the total deductions amount.

- Calculate your total amount due by following the instructions for adding any interest and penalties as necessary.

- If applicable, check any boxes notifying of changes such as a new ownership or business closure and provide the required information.

- Complete the declaration section by signing and dating the form, ensuring it is accurate to the best of your knowledge.

- Review all entries for accuracy before saving changes, and decide whether to download, print, or share the completed form.

Begin completing your Form Os 114 online today for a smoother filing experience.

To amend Form 114, you must fill out the revised information and submit it as soon as possible. The IRS allows corrections to be made, provided you act within the required timeframe. By properly amending your Form Os 114, you can rectify previous mistakes and ensure compliance. For guidance, uslegalforms can provide valuable resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.