Loading

Get Form 15d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15d online

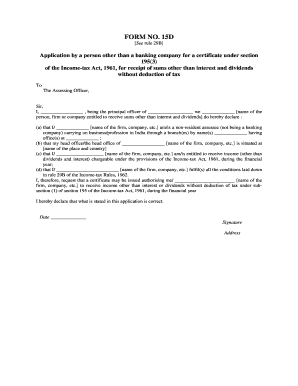

Filling out Form 15d accurately is essential for individuals or entities seeking a certificate under section 195(3) of the Income-tax Act, 1961. This guide provides clear, step-by-step instructions to help you navigate the online form completion process with confidence.

Follow the steps to complete Form 15d online.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Enter your name in the blank space provided for the principal officer of the entity.

- Fill in the name of the person, firm, or company entitled to receive income other than interest and dividends.

- Indicate your status as a non-resident assessee and specify the business or profession conducted in India along with the names of the branches.

- Provide the address of your office or the offices where the business is conducted.

- State the location of your head office including the city and country.

- Confirm that you or your entity are entitled to receive income (other than dividends and interest) chargeable under the Income-tax Act during the financial year.

- Ensure you meet all conditions as outlined in rule 29B of the Income-tax Rules.

- Request the issuance of a certificate authorizing the receipt of income without tax deduction.

- Complete the application by signing, adding the date, and including your address.

Begin your document preparation now and file your Form 15d online with ease.

You can get Form 15G from several places, including the official income tax department website and legal document platforms like US Legal Forms. Simply search for Form 15G, and ensure to download the most current version for your use. This will help you avoid complications related to tax withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.