Loading

Get Irs Form 8379 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8379 online

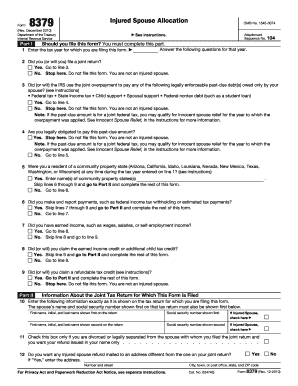

The IRS Form 8379, known as the Injured Spouse Allocation form, is designed to help individuals allocate their share of a tax refund when their spouse has debts that could reduce that refund. This guide provides a clear, step-by-step approach to filling out the form online, ensuring you have all the necessary information.

Follow the steps to complete Form 8379 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the tax year you are filing for by entering it in the designated field. This is essential as it determines the context for the allocation.

- Answer the question regarding whether you filed a joint return. Select 'Yes' if applicable, and proceed to the next question. If 'No,' stop here as you are not eligible to file this form.

- Provide a response to whether the IRS will use your joint overpayment to pay off any legally enforceable past-due debts solely owed by your spouse. If 'Yes,' continue to the next question. If 'No,' stop here.

- Confirm if you are legally obligated to pay the identified past-due amount. If the answer is 'Yes,' you cannot file this form. If 'No,' move to the next question.

- Indicate whether you were a resident of a community property state during the tax year. Answer 'Yes' and list the community property state(s) if applicable, and skip the next lines to complete Part II. If 'No,' proceed to the next question.

- Determine if you made and reported payments during the tax year. If 'Yes,' skip to Part II. If 'No,' go to the next question.

- Provide details on whether you had earned income such as wages or salaries. If 'Yes,' move to the next question. If 'No,' skip it.

- State if you claimed the earned income credit or additional child tax credit. If 'Yes,' skip the next question and complete Part II. If 'No,' proceed.

- Answer if you claimed a refundable tax credit. If 'Yes,' go to Part II and complete the rest of the form. If 'No,' stop here.

- In Part II, fill in your personal information, including names and Social Security numbers as they appear on the joint return.

- Check the appropriate box if you are divorced or legally separated and wish your refund issued solely in your name.

- Indicate if you want the injured spouse refund to be mailed to a different address. If so, provide the new address details.

- In Part III, allocate the items on the joint tax return by providing totals for income, adjustments, deductions, exemptions, credits, taxes, and payments.

- Complete Part IV by signing the form, certifying that the information is accurate to the best of your knowledge, and dating your signature.

- Finally, save changes, download, print, or share your completed form as needed.

Start filling out your IRS Form 8379 online today to ensure a smooth and accurate submission!

IRS Form 8379 is designed for individuals to claim their portion of a tax refund when the other spouse has unpaid legal obligations. This form allows the 'injured spouse' to assert their entitlement to a tax refund that may otherwise be taken to settle debts. It is an important tool to secure your financial rights as a taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.