Loading

Get Charles Schwab W 8ben 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charles Schwab W 8ben online

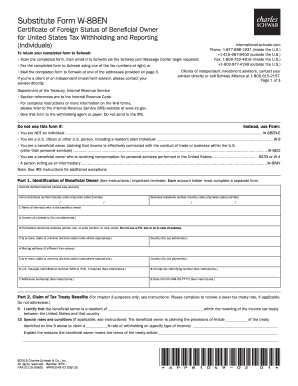

Filling out the Charles Schwab W 8ben form is essential for foreign individuals to establish their foreign status for U.S. tax withholding. This guide provides detailed, step-by-step instructions that will help users navigate the form easily.

Follow the steps to complete the Charles Schwab W 8ben form online.

- Click ‘Get Form’ button to obtain the W 8ben form and open it in the editor.

- Provide your full name as the beneficial owner in line 1 of the form. Ensure it matches the name on your identification.

- Enter your country of citizenship in line 2. Do not abbreviate the name of the country.

- Fill in your permanent residence address in line 3. This should be complete, including street, city, and postal code, without using a P.O. box.

- If your mailing address differs from your permanent address, provide it in line 4.

- If applicable, enter your U.S. taxpayer identification number in line 5 or your foreign tax identifying number in line 6.

- Include reference numbers, if any, in line 7 for your records or to help the withholding agent identify your form.

- Provide your date of birth in line 8 following the MM-DD-YYYY format.

- Complete line 9 to certify your residency in a country with an income tax treaty with the United States.

- If claiming tax treaty benefits, specify any special rates or conditions in line 10.

- Sign and date the form in the certification section, ensuring the declaration is truthful.

- After completing the form, save your changes, and prepare to email, fax, or mail the form to Schwab using the provided instructions.

Complete your Charles Schwab W 8ben form online today to ensure proper tax withholding.

You should send your W-8BEN form online through the Charles Schwab platform if they provide an upload option. If you need to submit it by mail, address it according to the instructions provided by Charles Schwab. Always verify submission channels to ensure your form is sent to the correct destination, enhancing its chances of being processed promptly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.