Loading

Get The Assam Value Added Tax Rules, 2005 Form-63 See ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the THE ASSAM VALUE ADDED TAX RULES, 2005 FORM-63 online

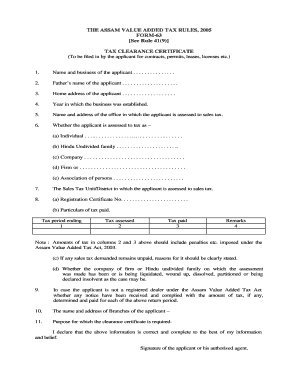

Filling out the THE ASSAM VALUE ADDED TAX RULES, 2005 FORM-63 is essential for obtaining a tax clearance certificate necessary for various business operations. This guide provides a step-by-step approach to help you complete the form accurately.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the name and business of the applicant clearly in the designated field.

- Enter the father's name of the applicant in the relevant section.

- Fill in the home address of the applicant accurately to ensure proper identification.

- State the year in which the business was established, providing a clear time frame of operation.

- Indicate the name and address of the sales tax office where the applicant is registered.

- Select the capacity in which the applicant is assessed, choosing from individual, Hindu Undivided Family, company, firm, or association of persons.

- Specify the sales tax unit or district applicable to the applicant's assessments.

- Fill in the Registration Certificate number as well as the tax details including the tax periods, amounts assessed, and amounts paid, along with any relevant remarks.

- If applicable, provide reasons for any unpaid sales tax in the specified section.

- Indicate whether there have been any liquidation or insolvency proceedings related to the business.

- For unregistered dealers, mention any notices received and ensure all tax determinations are reported accurately.

- List the branch names and addresses of the applicant, if any.

- Clearly state the purpose for which the tax clearance certificate is required.

- Finally, sign the form affirming that the provided information is complete and accurate.

- After reviewing your entries for accuracy, save changes, download, print, or share the completed form as necessary.

Begin your online process to fill out the document today!

Value-added tax is a consumption tax placed on a product whenever value is added at each stage of production or distribution. It allows businesses to collect tax on behalf of the government while prioritizing fair taxation practices. The Assam Value Added Tax Rules, 2005 Form-63 provides specific instructions on how value-added tax is calculated and administered in Assam.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.