Get Nv Ifta Online 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nv Ifta Online online

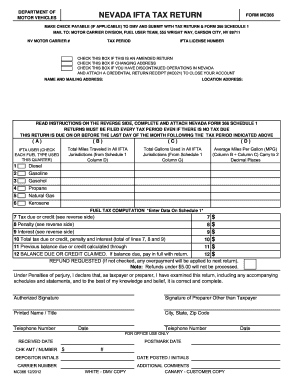

Filling out the Nevada IFTA Tax Return, Form MC366, is essential for all carriers licensed as Nevada-based IFTA carriers. This guide provides a comprehensive step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to complete your NV IFTA Online form

- Press the ‘Get Form’ button to access the required form and open it in your chosen editor.

- Fill in your Nevada Motor Carrier Number at the top of the form. This number is crucial for identifying your account.

- Indicate the Tax Period for which you are filing the return. Make sure it matches your records.

- Enter your IFTA License Number to ensure proper processing of your form.

- Check the appropriate boxes if you are submitting an amended return, changing your address, or if you have discontinued operations in Nevada.

- Provide your Name and Mailing Address, followed by your Location Address. This information is vital for communication purposes.

- Complete the fuel usage section by indicating the total miles traveled and total gallons used for each fuel type from Schedule 1.

- Calculate the Average Miles Per Gallon (MPG) for each fuel type using the formula provided, and enter it in the correct section.

- Fill in the Fuel Tax Computation section by calculating tax due or credit, penalties, and interest. Carefully review each line to ensure accuracy.

- Sign the return, either as the owner, partner, or corporate officer. If someone else prepared the form, they must also provide their signature.

- Once all sections are completed and reviewed, you can save your changes, download the form, print it, or share it as needed.

Get started on completing your NV IFTA Online form today to ensure timely filing and compliance.

For local operations, you generally do not need an MC number unless you are engaged in interstate commerce. If your services strictly include local transportation, you may not be required to obtain this number. However, it’s essential to stay informed about your specific operational needs to ensure compliance. Consider using the features of Nv Ifta Online to help you navigate these requirements effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.