Loading

Get Ir372 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir372 online

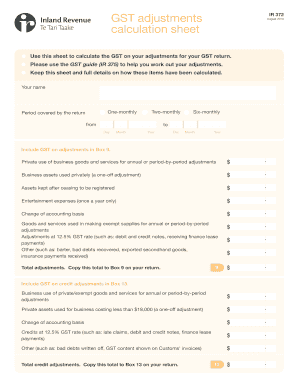

The Ir372 form is essential for calculating Goods and Services Tax (GST) adjustments for your GST return. This guide will provide you with a clear and user-friendly step-by-step process to complete this form online.

Follow the steps to fill out the Ir372 form accurately.

- Click 'Get Form' button to access the document and open it for editing.

- Enter your name in the designated field at the top of the form. This identifies you as the user submitting the GST adjustments.

- Select the appropriate filing frequency by marking either 'one-monthly', 'two-monthly', or 'six-monthly'. This indicates how often you make your GST returns.

- Specify the period covered by the return by entering the start date and end date in the respective fields. Include the day, month, and year for both dates.

- For Box 9, include GST on adjustments. This includes adjustments for private use of business goods and services, one-off adjustments for business assets used privately, entertainment expenses, and other relevant items. Calculate the total adjustments and copy this number to Box 9.

- For Box 13, include GST on credit adjustments. This comprises business use of private or exempt goods, one-off adjustments, and other credit-related items. After calculating the total credit adjustments, copy this number to Box 13.

- Review all entries for accuracy. Ensure all calculations are correct and that required values have been copied to the appropriate boxes.

- Once you have completed all sections, save your changes. You may download the form, print it, or share it as necessary.

Start filling out your documents online today and ensure your GST returns are accurate.

Filling out an expenditure form starts with gathering documentation for your expenses. Clearly state each expense and its purpose, ensuring that all numbers are correctly summed. The Ir372 guidelines provide a reliable framework to follow for accuracy and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.