Loading

Get Authority To Print

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Authority To Print online

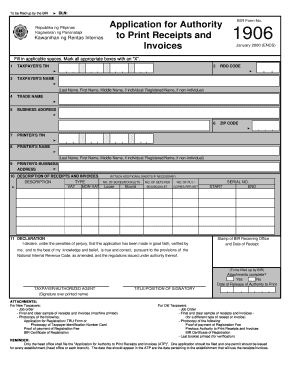

This guide provides comprehensive instructions on filling out the Authority To Print form online. Understanding each section of this document will help ensure that your application is completed accurately and efficiently.

Follow the steps to complete the Authority To Print form online.

- Click the ‘Get Form’ button to access the Authority To Print form and open it in your editor.

- Enter the Taxpayer Identification Number (TIN) in the designated area to identify your tax records.

- Provide the relevant Revenue District Office (RDO) code that corresponds to your place of business.

- Input your name in the Taxpayer's Name section, using the correct format: Last Name, First Name, Middle Name (if individual) or Registered Name (if non-individual).

- Fill in the Trade Name if applicable, which should represent the business under which you operate.

- Complete the Business Address field with your full business address, ensuring it is accurate.

- Input the Printer's TIN, which is necessary for the printing establishment you are utilizing.

- Provide the Printer's Name in the same format as the Taxpayer's Name, depending on whether it is an individual or non-individual.

- Fill out the Printer's Business Address field with the complete address of the printing establishment.

- In the Description of Receipts and Invoices section, detail the type of receipts or invoices you wish to print. Select if they are VAT or Non-VAT applicable and note the number of boxes/booklets required.

- Complete the Declaration section by ensuring you understand the content and confirming it is accurate by signing with your printed name. Include the title or position if applicable.

- Check the attachments section to confirm whether all required documents have been prepared.

- Finally, save your changes, and choose to download, print, or share the completed Authority To Print form.

Complete your Authority To Print application online today to ensure your printing needs are met swiftly.

To fill out a receipt form, begin by writing the date and a unique receipt number. Include both the service provider's and customer's information for clarity. Clearly indicate the items or services purchased, their costs, and the total amount billed. For legitimacy, ensure that your receipt includes the Authority To Print, confirming its official status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.