Get Hud 1003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hud 1003 online

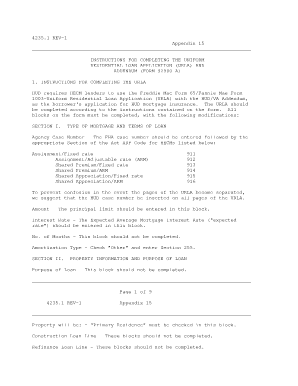

The Hud 1003 form, also known as the Uniform Residential Loan Application, is essential for those seeking HUD mortgage insurance. This guide provides comprehensive instructions for successfully completing the form online, ensuring all necessary information is accurately provided.

Follow the steps to fill out the Hud 1003 online.

- Click ‘Get Form’ button to obtain the Hud 1003 and open it in the online editor.

- In Section I, enter the Agency Case Number, filling in the appropriate FHA case number and Section of the Act ADP Code. Indicate the principal limit and the expected average mortgage interest rate. For Amortization Type, select 'Other' and enter Section 255.

- In Section II, specify that the property will be used as a 'Primary Residence.' Do not fill out the Purpose of Loan, Construction Loan Line, or Refinance Loan Line.

- Proceed to Section III and enter the number of dependents in the borrower information section. Do not provide a former address.

- Skip Section IV, as the fields are not required.

- For Section V, complete the blocks for gross monthly income, noting income from government sources as 'Other' income. Exclude the blocks for combined monthly housing expenses.

- In Section VII, complete Block d. with existing liens and Block f. with all closing costs. Make sure to include initial MIP in Block n.

- In Section VIII, complete blocks a., b., c., d., e., f., and l., while leaving other blocks blank.

- Finally, fill out Section X, which is for government monitoring purposes, ensuring all required fields are completed.

- Review all entered information, then save your changes. You can download, print, or share the Hud 1003 form as needed.

Complete your Hud 1003 online today and take the first step towards securing your mortgage.

No, Urla and the Hud 1003 are not the same, although they serve similar purposes in the mortgage application process. Urla is an updated version of the Hud 1003 and includes additional information requirements for borrowers. While both forms aim to provide lenders with necessary information, the Hud 1003 remains a foundational document for most mortgage applications. It is essential to understand the differences to ensure that you are using the correct form for your specific situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.