Get W2 Box 12 Codes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 Box 12 Codes online

Filling out the W2 Box 12 Codes can be a straightforward process when approached with the right guidance. This comprehensive guide will walk you through the necessary steps to accurately complete this section of your W2 form online.

Follow the steps to fill out the W2 Box 12 Codes smoothly.

- Click ‘Get Form’ button to access the W2 form and open it for editing.

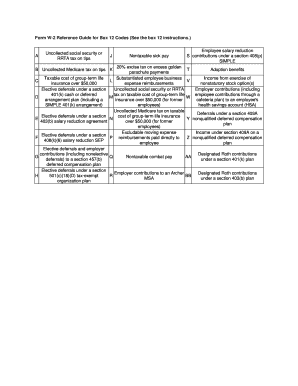

- Review the W2 Box 12 Codes section carefully. Each code signifies specific tax-related information. Familiarize yourself with the various codes such as A for uncollected social security tax on tips or D for elective deferrals under a 401(k) plan.

- Determine which codes apply to your situation and gather the necessary information from your financial documents or employer.

- Enter the relevant codes in the designated Box 12 field on the form. Ensure that you follow the correct format as specified in the instructions.

- Double-check your entries for accuracy. Mistakes can lead to tax complications, so it's vital to confirm that all codes are entered correctly.

- Once you have completed all necessary sections of the W2 form, save your changes and prepare to finalize your document.

- You can now download, print, or share the completed W2 form as needed to meet your filing requirements.

Start completing your W2 Box 12 Codes online today for a smoother tax filing experience.

The W code in box 12 of the W2 form in California refers to the employee's contributions to a health savings account or HSA. These contributions are important for understanding your tax situation, as they may be tax-deductible. Utilizing W2 box 12 codes can help you track your contributions more effectively. If you want to ensure your tax filing is accurate and optimized, consider using US Legal Forms for reliable resources and forms related to W2 documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.