Loading

Get 587 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 587 Form online

Filling out the 587 Form online can streamline the process of managing nonresident withholding allocation. This guide offers systematic instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the 587 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

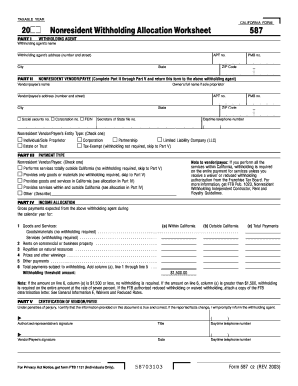

- In Part I, provide the name and address of the withholding agent. Make sure to include the street number, city, state, and ZIP code accurately.

- Proceed to Part II. Enter the vendor/payee's name and address, including any applicable apartment number and private mailbox number, ensuring the information is correct.

- Indicate the type of entity for the vendor/payee by checking the appropriate box in the Nonresident Vendor/Payee section. Specify if they are an individual, corporation, partnership, etc.

- In Part III, select the payment type that applies. Check the box that describes the nature of the services or goods being provided to determine if withholding is necessary.

- Fill out Part IV to report income allocation. Enter gross payments expected from the withholding agent during the calendar year, specifying amounts from California and outside California.

- In Part V, certify the accuracy of the provided information. Sign and date the form, ensuring that all details are accurate and complete.

- After completing the form, you can save changes, download it for your records, print a copy, or share it as needed.

Complete your 587 Form online to ensure compliance with California's nonresident withholding requirements.

When filling out the California DE4 form, begin by entering your personal information and desired number of allowances. This number directly affects how much tax is withheld from your paycheck. Utilizing the 587 Form can complement this process by ensuring that your allowances align with your overall tax strategy. Take a moment to review the instructions for entering details correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.