Loading

Get Rev 181 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 181 online

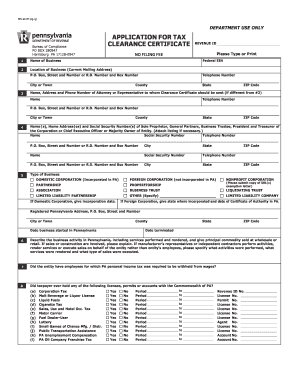

Filling out the Rev 181 form for a tax clearance certificate is an essential step for businesses in Pennsylvania. This guide provides a comprehensive overview and step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to effectively complete the Rev 181 form.

- Press the ‘Get Form’ button to access the Rev 181 form and open it in your preferred online editor.

- Begin by entering the name of your business in the designated field at the top of the form. Make sure to type or print clearly.

- Provide your Revenue ID and Federal Employer Identification Number (EIN) in the appropriate fields.

- Complete the current mailing address of your business, including the street number, city or town, state, and ZIP code.

- If applicable, fill in the details of your attorney or representative who should receive the clearance certificate. Include their name, phone number, and address.

- List the names, home addresses, and Social Security numbers of all owners or key operational figures associated with your business, such as sole proprietors, general partners, and executive officers.

- Select the type of business entity by marking the appropriate box. If you're a domestic corporation, include the incorporation date, or if a foreign corporation, provide the state of incorporation and relevant dates.

- Indicate the date your business started and, if applicable, the date it terminated in Pennsylvania.

- Describe the business activity conducted in Pennsylvania, including services offered and principal commodities sold.

- Answer whether the entity had any employees subject to Pennsylvania personal income tax withholding and provide necessary details.

- Respond to questions regarding any licenses or permits held in Pennsylvania, marking 'Yes' or 'No' and supplying relevant details.

- Complete additional relevant sections regarding real estate holdings and any business assets or activities acquired from previous business entities.

- Fill out the clearance certificate's purpose by checking the appropriate box that reflects your situation (e.g., dissolution, withdrawal, merger).

- After completing all sections, review the entire form for accuracy and submit your original typed application to the appropriate Pennsylvania Department addresses.

- Once satisfied with the form, you can save changes, download, print, or share the filled-out Rev 181 as needed.

Complete your tax clearance certificate application online today.

To fill out tax amnesty applications, you should carefully read the instructions and gather all necessary information. Utilize the guidelines in Rev 181 to ensure you meet all requirements and provide accurate details. Completing this application correctly can significantly reduce your tax burden. The USLegalForms platform offers templates and tools to facilitate this process, making it easier for you to comply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.