Loading

Get Form M 28

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M 28 online

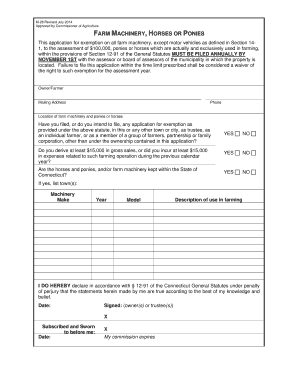

Filling out the Form M 28 is an essential step for those seeking an exemption for farm machinery, horses, or ponies used in agricultural operations. This guide will provide you with clear instructions to complete the form online easily.

Follow the steps to complete the Form M 28 online:

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your name in the 'Owner/Farmer' field, followed by your mailing address and phone number.

- Fill in the 'Location of farm machinery and ponies or horses' section with the specific locations pertinent to your property.

- Indicate whether you have filed or intend to file any related application for exemption in other municipalities by selecting 'YES' or 'NO.'

- Complete the question about your gross sales or incurred expenses related to farming operations by checking 'YES' or 'NO.' Ensure the income or expenses meet the threshold of $15,000.

- Answer whether the horses and ponies, and/or farm machinery are kept within the State of Connecticut by selecting 'YES' or 'NO.' If 'YES,' list the relevant towns.

- For items under 'Machinery,' provide the make, year, model, and description of use in farming for each piece of equipment.

- Review the declaration statement, confirming that all information provided is accurate to the best of your knowledge. Date the form.

- Sign the form as the owner(s) or trustee(s), ensuring you complete the signature section.

- Confirm the signing by a notary by filling out the necessary information, including the expiration date of the notary's commission.

- After completing all fields, save your changes, and then download, print, or share your completed form as required.

Start completing your Form M 28 online today to ensure you meet the annual filing requirement!

Related links form

The designated form for power of attorney regarding Massachusetts taxes is Form M-2848. This document allows individuals to authorize someone to act on their behalf concerning tax matters. When considering this process, leveraging resources like Form M 28 will provide you with the necessary context and instructions to ensure your paperwork is correctly filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.