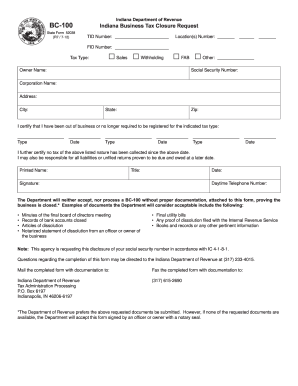

Get Bc 100 Form Indiana 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Bc 100 Form Indiana online

How to fill out and sign Bc 100 Form Indiana online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience the advantages of completing and submitting forms online. With our system, filling out the Bc 100 Form Indiana takes only a few minutes. We enable this by providing you with access to our feature-packed editor that can alter/correct a document's original text, add unique fields, and include your signature.

Complete the Bc 100 Form Indiana in only a few minutes by following the steps outlined below:

Submit the completed Bc 100 Form Indiana in electronic format once you finish filling it out. Your information is securely protected, as we adhere to the latest security standards. Join millions of satisfied customers who are already completing legal forms from the comfort of their homes.

- Locate the document template you require from our library of legal forms.

- Select the Get form button to access the document and proceed to editing.

- Fill in all the mandatory fields (these are highlighted in yellow).

- The Signature Wizard will allow you to add your electronic signature as soon as you have finished entering your information.

- Enter the date.

- Review the complete template to ensure you have filled out all the necessary information and that no alterations are needed.

- Click Done and store the completed document on your device.

How to Alter the Get Bc 100 Form Indiana 2020: personalize documents online

Streamline your documentation routine. Uncover the most efficient method to locate, modify, and submit a Get Bc 100 Form Indiana 2020

The task of preparing the Get Bc 100 Form Indiana 2020 demands accuracy and focus, particularly for those who lack familiarity with this sort of work. It is crucial to obtain an appropriate template and populate it with accurate data. With the right tools for handling documentation, you can access everything necessary. Simplifying your editing process is straightforward without the need for new skills. Determine the correct version of the Get Bc 100 Form Indiana 2020 and complete it swiftly without toggling through your browser tabs. Explore additional tools to personalize your Get Bc 100 Form Indiana 2020 document in the editing section.

While on the Get Bc 100 Form Indiana 2020 page, simply click the Get form button to initiate editing. Enter your information into the form directly, as all the required tools are available right here. The template is pre-formatted, so the user’s contribution is minimal. Just utilize the interactive fillable fields within the editor to seamlessly finalize your documents. Click the form to enter the editor mode without hesitation. Populate the interactive field, and your file is ready.

Explore more tools to personalize your document:

Often, a minor mistake can undermine the entire form when someone completes it manually. Eliminate inaccuracies in your documentation. Locate the templates you need quickly and finalize them electronically through an intelligent editing solution.

- Insert additional text around the document if necessary. Use the Text and Text Box features to add text in a separate box.

- Incorporate pre-designed graphical elements such as Circle, Cross, and Check with the respective tools.

- Capture or upload images to the document using the Image feature if needed.

- If you need to sketch something in the document, use Line, Arrow, and Draw tools.

- Utilize the Highlight, Erase, and Blackout tools for text customization within the document.

- For comments on specific sections of the document, click the Sticky tool to place a note where desired.

Related links form

In Indiana, various purchases qualify for sales tax exemption, including certain groceries, prescription drugs, and manufacturing equipment. To claim an exemption, you typically must provide an Indiana retail merchant certificate or other documentation supporting your claim. Understanding these exemptions can help you save on taxes while making necessary business purchases.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.