Get Wh 4p 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wh 4p online

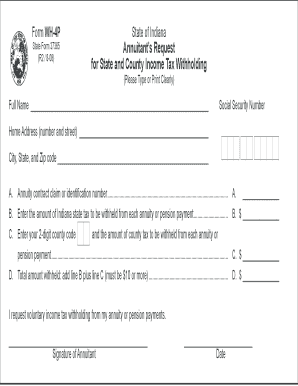

The Wh 4p form is designed for annuitants to request state and county income tax withholding from their annuity or pension payments. This guide provides clear instructions on how to fill out the form accurately and effectively online.

Follow the steps to complete the Wh 4p form online:

- Press the ‘Get Form’ button to obtain the Wh 4p form and open it in your preferred online editor.

- Enter your full name in the designated field. Ensure that the name matches the name associated with your Social Security account.

- Provide your Social Security number in the appropriate field. This is crucial for your tax records.

- Input your home address including the number and street, city, state, and zip code in the designated fields.

- In section A, enter the annuity contract claim or identification number to which your request pertains.

- In section B, state the amount of Indiana state tax you wish to withhold from each annuity or pension payment.

- In section C, enter your 2-digit county code and the desired amount of county tax to be withheld from your annuity or pension payment.

- For section D, calculate the total amount to be withheld by adding the amounts from lines B and C. Ensure this total is $10 or more.

- Sign the form in the designated area, confirming your request for voluntary income tax withholding.

- Date your signature to finalize your request. Make sure the date is clearly included.

- Once completed, save your changes, and then download, print, or share the form as needed. Remember to send the form to the person or company responsible for paying your pension, not the Department of Revenue.

Complete your Wh 4p form online today to ensure proper income tax withholding from your annuity or pension payments.

Related links form

To maximize your refund on your W4, consider claiming more allowances than you might typically qualify for. This action leads to less tax being withheld from your paycheck, effectively increasing your final refund amount. However, be cautious not to under-withhold, as this could result in owing taxes at year-end. For users who want more clarity on this process, uslegalforms offers helpful resources and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.